New Bangsar South branch showcases ‘future of banking’ concept with innovative and customer-focused experiences

Maybank has reinforced its leadership in community banking with the expansion of its national footprint, now covering 473 touchpoints nationwide, strategically positioned in high growth areas and vibrant communities. Guided by its purpose of Humanising Financial Services, the Bank remains focused on making banking accessible, relevant, and inclusive for the communities it serves – from bustling urban hubs to regional economic corridors and university campuses.

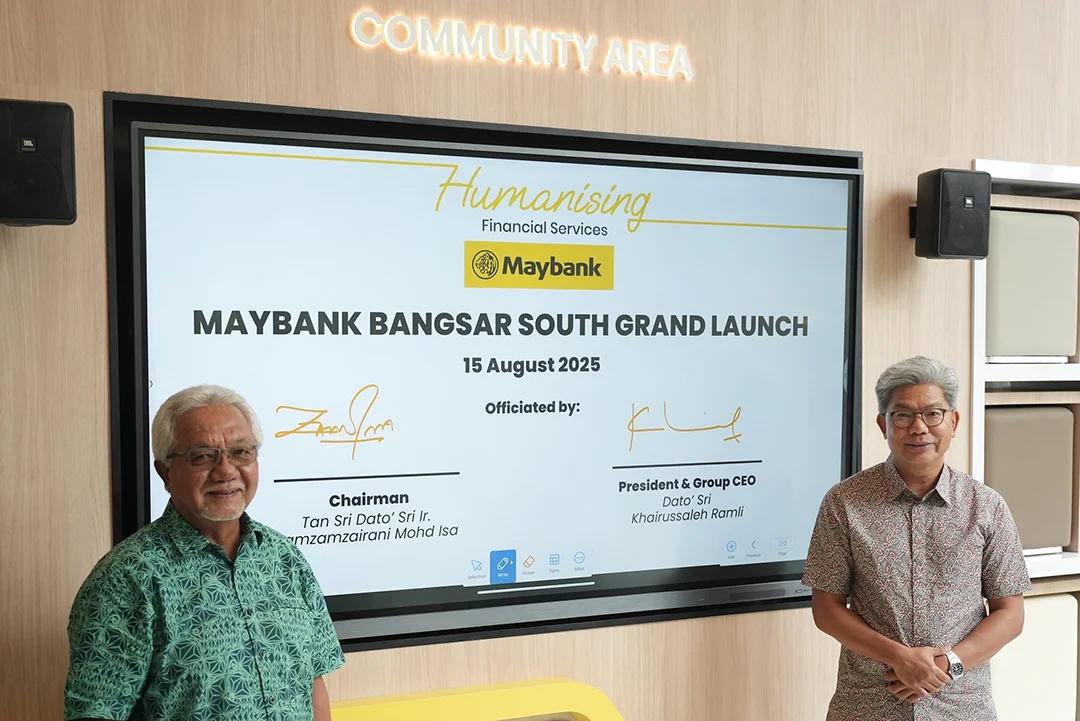

L- R:Tan Sri Zamzamzairani Mohd Isa, Chairman, Maybank & Dato’ Sri Khairussaleh Ramli, President & Group CEO, Maybank

As part of this expansion, the Bank recently launched its new Bangsar South branch, showcasing a next-generation branch concept that embodies the Bank’s vision of the future of banking. This concept reflects the Bank’s long-term strategy to reimagine a branch experience that is smarter, seamless, and more personal.

In addition to its conventional and Islamic branches, Maybank’s physical touchpoints in Malaysia also include Service Centres, Private Wealth Centres, Premier Wealth Centres, Auto Finance Centres, SME Centres, and Commercial Centres – collectively forming the largest physical banking network in Malaysia.

“While digital banking continues to grow rapidly, we know that physical touchpoints remain vital in ensuring financial inclusion, especially in communities that value face-to-face interaction. Our goal is to combine digital innovation with the personal touch of human connection, delivered through Malaysia’s most extensive and accessible banking network.

Maybank Bangsar South is a showcase of this approach, reimagining the banking experience to be more open, personal, and community-driven. It reaffirms our commitment to serve every segment of society,” said Syed Ahmad Taufik Albar, Group CEO, Community Financial Services, Maybank.

Syed Ahmad Taufik Albar, Group CEO, Community Financial Services, Maybank.

Located in one of Kuala Lumpur’s fastest-growing districts and a hub for Malaysian start-ups, Maybank Bangsar South introduces several innovations to enhance the branch experience:

- ‘Service Anywhere’ approach: Customers can be served throughout the branch and not just at fixed counters, ensuring a more personal and comfortable interaction.

- Community Area: A vibrant co-creation space open to the public for events, workshops, and collaborations, making visits less transactional and more about connection.

- Digital Xperience Zone: A self-service area equipped with iPads and Smart Recycling Machines (SRM).

- Virtual Room: A private space where customers can connect via secure video conferencing with Maybank Group Customer Care or product specialists.

In May this year, Maybank also launched its ninth Maybank@Campus touchpoint at UiTM Puncak Alam, with a tenth in the pipeline, in Universiti Utara Malaysia (UUM). Serving nearly 220,000 tertiary students and campus communities, Maybank@Campus touchpoints feature a digital-first, self-service concept that enables quick and convenient everyday banking services, while also hosting financial literacy programmes and other youth-focused initiatives.

In the coming months, Maybank will be launching two new touchpoints in Johor’s Forest City and Medini, further strengthening its presence in Johor, where the Bank already operates 59 touchpoints – the largest in the state. With Forest City designated as a Special Financial Zone within the Johor-Singapore Special Economic Zone (JS-SEZ), these new touchpoints will support the growing local and international business community with cross-border investments, tailored advisory and wealth solutions, as well as financing needs for individuals, business owners, and foreign investors.

By enhancing its physical presence in growth areas across the country, Maybank aims to strengthen its role as a trusted institution for individuals, businesses, and the communities it serves. These physical network expansions reflect the Bank’s commitment to providing customers across all segments with banking that is both digitally empowered and physically accessible.